Smartphone Industry Grows in Australia

The premium (>A$1,000) and budget The upcoming 3G network shutdown by Telstra and Optus, which will force many users to upgrade, and the increased demand for flagship models with cutting-edge AI capabilities are the main causes of this market polarisation.

Read More From Smartphone

Notwithstanding the surge in sales, consumers’ average smartphone replacement cycle or the amount of time they spend using their phones extended by six months in 2023 to almost four years.

This change is a result of ongoing pressures from the cost of living, longer-lasting devices and more software support. The trend is most noticeable in the sub-A$1,000 market, where devices need to be replaced more frequently than premium ones—by at least a year.

Over the past year, the cycles for replacing high-end smartphones have stayed consistent.

Sales of smartphones increased on both major platforms, but Android grew at a double-digit rate (12% vs. 4%), surpassing iPhones. According to Telsyte, this increase can be ascribed to the spread of smartphones that have genAI built in as well as Android’s wide range of pricing points, which better served customers looking for less expensive 3G substitutes.

Apple and Samsung continued to be the top two suppliers. Either Oppo or Motorola could have been in third place any given month with Motorola getting closer to Oppo every year.

During the six months under evaluation, approximately one-third of all sales were made up of GenAI phones, which include the Apple iPhone 15 Pro series. Apple’s sales were driven by the iPhone 15 Pro series, which was expected to work with the upcoming Apple Intelligence release.

AI-Powered Smartphone’s on the Rise

More than seven million Australians have already adopted genAI apps, such as Google’s Gemini, Microsoft Copilot, OpenAI’s ChatGPT, and Meta AI, according to Telsyte’s most recent study. Nonetheless, two-thirds of Gen AI app users voiced worries about, how third-party apps handle their data.

According to the survey only 35% of smartphone owners have faith in the services and products offered by their device’s manufacturer 39% of Apple users have the highest level of trust.

Read More From Tech Solutions

Less than half of genAI users access apps via smartphones. While 75% of genAI users access apps via computers, making computers the primary device for genAI access. However, Telsyte believes that with the growing availability of genAI smartphone features. Smartphones could close the gap in less than two years.

One-sixth of users said their next phone “must have” advanced AI features, indicating a growing but still emerging demand for on-device AI features, according to the study.

By 2025, 31% of those intending to buy a smartphone would consider upgrading for advanced on-device AI features, which represents one in five smartphone users overall.

With half of smartphone users interested in AI-assisted text generation, live translation, photo and video editing and other features, there is still a high demand for new features.

Only 36% of interested users for example, are prepared to pay slightly less than $10 per month for these features.

Despite ongoing cost-of-living pressures, Telsyte predicts that 8.7 million smartphones will be sold in 2024, a 7% increase driven by the desire for better data security, high-end phones with on-device AI features, and the desire to “future-proof” smartphone purchases given the intention to use phones for up to five years.

It is anticipated that by 2024, genAI smartphones which are becoming more and more accessible from manufacturers like Samsung, Apple, Google, Motorola, Oppo and Asus will account for two out of every five smartphones sold.

In the next 12 to 18 months, the impending release of Apple Intelligence may lead to a significant cycle of iPhone upgrades that will rival the expanding trends of premium Android devices.

Read More From Apple

This depends on Apple’s capacity to demonstrate private, context-aware AI, that runs on devices and can be easily incorporated into routines and apps.

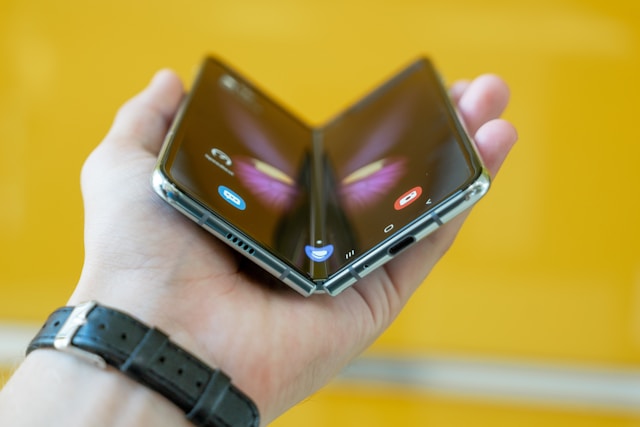

The popularity of foldable smartphones is still rising and new designs like Huawei’s recently unveiled trifold design are pushing the limits of form factor evolution.

In 2023, foldable smartphones made up 8% of all Android smartphone sales. Telsyte predicts that by 2024 this percentage may rise to 10% due to both new and current products from Samsung, Google, Motorola and Oppo.

According to Foad Fadaghi, managing director of Telsyte, “On-device generative AI upgrades and new form factors are breathing life into an otherwise very mature sector.”

Fadaghi asserts, “Manufacturers could do more to inform their customers about the benefits and security features of their genAI platforms.”

The success of smart wearables is driven by health and fitness tracking.

The market for smart wearables is driven by Australians’ dedication to fitness and health, as evidenced by the nearly two-thirds of users who say they want to maintain their level of fitness.

Read More From Google

In the first half of 2024, over a million smart wrist wearables were sold, representing a 2% year-over-year increase. Three-quarters of these sales were made up of smartwatches. Leading the rankings of wrist wearable vendors are Apple, Samsung and Fitbit.

The survey also showed that Australians are receptive to novel wearable technology, such as “smart rings.” Approximately 25% of Australians are already familiar with this covert wearable technology. Which is marketed by companies such as Oura, Samsung, Ultrahuman and RingConn.

29% of those who were aware said they would be willing to spend almost A$500 on one in order to wear one for fitness, health monitoring and mobile payments.

Alvin Lee, a senior analyst at Telsyte, states that smart rings might be a more pleasant alternative to wrist-worn devices for monitoring health at night.

Over 1.3 million smart wearables were sold during that time, a 6% increase over the previous year. Australians who want more affordable tech upgrades that improve cross-device experiences will still find this category appealing.